how to pay indiana state estimated taxes online

Have more time to file my taxes and I think I will owe the Department. For more information visit INTIME.

Dor Keep An Eye Out For Estimated Tax Payments

Learn about state requirements for estimated quarterly tax payments.

. Know when I will receive my tax refund. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Claim a gambling loss on my Indiana return.

If you expect to have income during the tax year that. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Call the department at 608 266-2486 to request tha t we mail vouchers to you.

All payments must be made with US. Mail a check or money order. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a.

Take the renters deduction. The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or eCheck. Online Services Pay Taxes Electronically INTIME INTIME provides access to manage and pay individual income and various corporate and business tax obligations.

If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. Can I Pay My Indiana State Tax Online. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service.

Find Indiana tax forms. There are several options available for making estimated payments. Do Not mail Form ES-40 if paying by credit card or eCheck.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. Go to the departments tax forms to complete and print the interactive Form 1-ES Voucher. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. Write your Social Security number on the check or money order.

Know when I will receive my tax refund. Visit our website at wwwingovdor4340 and follow the prompts for making an estimated tax payment. The document has moved here.

Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools. Check or money order follow the payment instructions on the form or voucher associated with your filing or. Have more time to file my taxes and I think I will owe the Department.

Paying online Filling out ES-40. Indiana Department of Revenue. Choose to pay directly from your bank account or by credit card service provider fees may apply.

One to the IRS and one to your state. Some states also require estimated quarterly taxes. Pay my tax bill in installments.

This means you may need to make two estimated tax payments each quarter. Vehicle use tax bills RUT series tax forms must be paid by check. How to Pay Indiana State Taxes Step 1.

Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and. Claim a gambling loss on my Indiana return.

INTIME makes it easy to pay with a credit card check or card payment. If you owe more than 100 go online and use INTIMEs payment plan. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours.

You can pay with credit cards online or over the telephone. To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer Information Management Engine INTIME at intimedoringov. Find Indiana tax forms.

If you dont wish to pay by credit card you can use your electronic check or a check cashed by INTIME. A payment can be made in person at the DORs district office or downtown Indianapolis location by cash exact change only credit card money order or check. Decide on your method of payment.

All payments must be made with US. Enclose your check or money order made payable to the Indiana Department of Revenue. Estimated payments will apply to the quarter in which they are received.

Payment for tax due on the 2021 MI-1040 Payment in response to a 2021 Proposed Tax Due letter sent to you by the Michigan Department of Treasury Michigan Estimated Income Tax for Individuals MI-1040ES Select the payment type 2022 Estimate. Ready to access the Indiana Taxpayer Information Management Engine INTIME. To pay by credit card you may make an estimated tax payment online.

If you want to receive future bills from the Tax Department online the best way is to create an Online Services account and request electronic communications for Bills and Related Notices. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. ECheck - You will need your routing number and checking or savings account number.

INtax only remains available to file and pay the following tax obligations until July 8 2022. Resolution and response Options Request an installment payment agreement IPA If you cant pay your tax bills in full request an IPA. You can also pay.

Electronic payment using Revenue Online. Write your Social Security number on the check or money order. Estimated payments can be made by one of the following methods.

Filling out Form ES-40. Make a Payment via INTIME INTIME user guides are available if needed. Take the renters deduction.

How Do I Pay My Indiana State Taxes Online. Pay by telephone using. Make a payment using the online payment option on the departments website.

Payment of estimated taxes Estimated payments can be made by one of the following methods. When you wish to pay in person please visit one of DORs district offices or downtown Indianapolis location. Any payment received after the.

You can also make your estimated tax payment online via INTIME at intimedoringov. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Pay my tax bill in installments.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. When To Pay Estimated Taxes For estimated tax purposes the year is divided into four payment periods.

Solved How Do I Enter State Estimated Tax Credits To Turb

U S States With Highest Gas Tax 2021 Statista

Where S My State Refund Track Your Refund In Every State

How High Are Capital Gains Taxes In Your State Tax Foundation

Indiana State Tax Information Support

How Do State And Local Individual Income Taxes Work Tax Policy Center

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

States With Highest And Lowest Sales Tax Rates

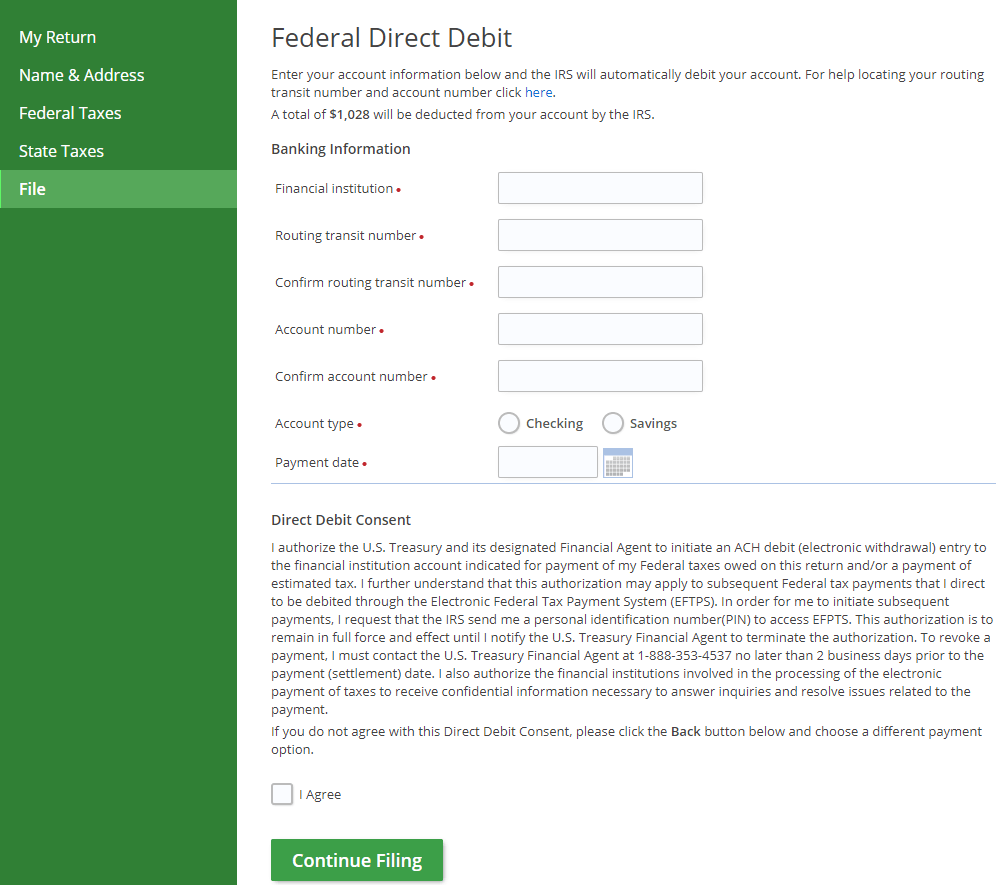

Pay Your Federal State Taxes On Efile Com Debit Check

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Taxation Of Social Security Benefits Mn House Research

How Do State And Local Sales Taxes Work Tax Policy Center

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)